Job Search Scams: How to Identify and Avoid Them – Protecting Yourself in the Digital Job Market

The excitement of finding what appears to be the perfect job opportunity can quickly turn into a nightmare when that opportunity turns out to be a sophisticated scam. As the job market has increasingly moved online, fraudulent job postings and employment scams have become more prevalent and sophisticated, targeting vulnerable job seekers with promises of easy money, work-from-home opportunities, and dream positions.

Job search scams don’t just waste your time – they can result in identity theft, financial loss, and emotional distress that can derail your legitimate job search efforts. Understanding how to identify, avoid, and respond to these scams is crucial for protecting yourself while navigating today’s digital job market.

This comprehensive guide will equip you with the knowledge and tools needed to distinguish legitimate opportunities from fraudulent schemes, ensuring your job search remains both productive and secure.

Understanding the Landscape of Job Search Scams

The Growing Threat

Employment scams have increased dramatically in recent years, with the Federal Trade Commission reporting that job-related fraud complaints have risen by over 300% since 2019. The shift to remote work and online job searching has created new opportunities for scammers to exploit job seekers’ desperation and hope.

These scams target individuals across all experience levels and industries, but certain groups are particularly vulnerable: recent graduates, people facing unemployment, individuals seeking work-from-home opportunities, and those in financial distress. Scammers exploit these vulnerabilities by offering seemingly perfect solutions to common job search challenges.

The Cost of Job Scams

The impact of job search scams extends far beyond the immediate financial losses. Victims often experience:

- Direct financial losses from upfront fees, fake check scams, or identity theft

- Compromised personal information leading to long-term identity theft issues

- Emotional trauma and loss of confidence in legitimate job searching

- Wasted time and energy that could have been spent on genuine opportunities

- Potential legal complications if unknowingly involved in money laundering schemes

Understanding these risks underscores the importance of maintaining vigilance throughout your job search process.

Common Types of Job Search Scams

Work-from-Home Scams

The popularity of remote work has created fertile ground for scammers offering too-good-to-be-true work-from-home opportunities.

Package Reshipping Scams Scammers offer positions as “shipping coordinators” or “package processors” where you receive packages at your home and reship them to other addresses. These schemes often involve stolen merchandise or fraudulent purchases, making victims unknowing accomplices to criminal activity.

Data Entry and Online Survey Scams Fraudulent companies promise easy money for simple data entry work or completing online surveys. They typically require upfront payments for “training materials” or “software access” that never materialize into actual paid work.

Virtual Assistant Scams Fake companies recruit virtual assistants for tasks like customer service or administrative support. After collecting personal information during the “hiring” process, scammers use this data for identity theft or ask for payment for equipment or training.

Fake Check Scams

These sophisticated scams involve sending victims checks for amounts larger than agreed-upon payments, then asking them to deposit the check and return the excess amount.

Mystery Shopping Scams Scammers pose as legitimate mystery shopping companies, sending fake checks with instructions to evaluate money transfer services by sending back the “excess” funds. When the fake check bounces, victims are responsible for the full amount.

Personal Assistant Scams Fake employers hire “personal assistants” to handle financial transactions, including depositing checks and transferring funds. Victims unknowingly participate in money laundering while facing financial liability when fake checks are discovered.

Upfront Fee Scams

These scams require payment before any work begins, violating the fundamental principle that legitimate employers pay employees, not the other way around.

Training and Certification Scams Fake companies offer employment contingent on completing expensive training programs or obtaining specific certifications through their “approved” providers. After payment, the training is worthless, and the promised job never materializes.

Equipment and Software Scams Scammers require purchases of specific equipment, software, or supplies before starting work. They may promise reimbursement that never comes or sell overpriced, unnecessary items.

Background Check and Application Fee Scams Fraudulent employers request payment for background checks, credit reports, or application processing fees before considering candidates for positions.

Identity Theft Job Scams

These scams focus primarily on collecting personal information for identity theft purposes.

Fake Job Applications Scammers create realistic job postings and application processes to collect Social Security numbers, bank account information, and other sensitive personal data from applicants.

Phishing Interview Scams Fraudsters conduct fake interviews, either over the phone or through video calls, to gather personal information while appearing to evaluate candidates for legitimate positions.

Pyramid Schemes and MLM Scams

While not always illegal, many multi-level marketing opportunities are presented as traditional employment when they’re actually pyramid schemes requiring recruitment of new participants to generate income.

Recruitment-Based “Jobs” These positions focus primarily on recruiting new members rather than selling actual products or services. Success depends on building a network of recruits rather than individual performance or skills.

Investment Opportunity Scams Scammers present investment opportunities disguised as employment, requiring upfront investments with promises of guaranteed returns through “work” that involves recruiting others to invest.

Critical Warning Signs: Red Flags That Demand Attention

Too-Good-to-Be-True Promises

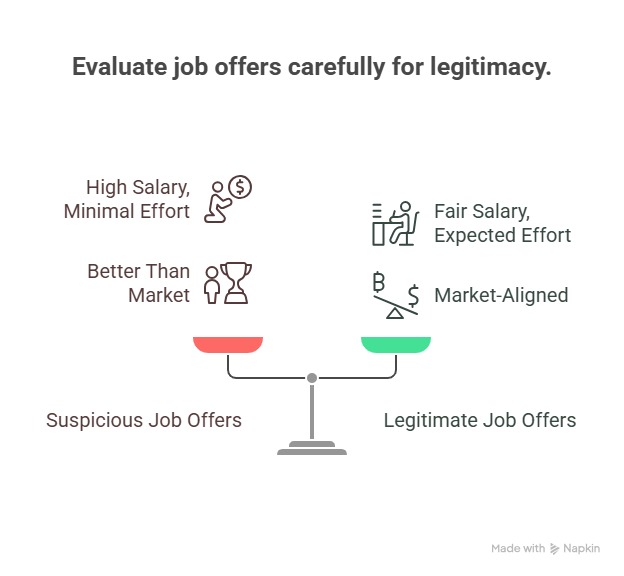

Legitimate employers rarely promise extraordinary compensation for minimal work or experience. Be immediately suspicious of:

- Extremely high salaries for entry-level or unskilled positions

- Promises of guaranteed income with minimal effort

- Claims of earning potential that seems disproportionate to job requirements

- Offers that seem significantly better than similar positions in the market

Poor Communication and Unprofessional Presentation

Professional organizations maintain consistent, high-quality communication standards. Warning signs include:

- Generic email addresses (Gmail, Yahoo, Hotmail) instead of company domains

- Poor grammar, spelling errors, and unprofessional language

- Vague job descriptions that don’t clearly explain responsibilities or requirements

- Inconsistent company information across different communications

- Pressure to respond immediately without time for consideration

Requests for Personal or Financial Information

Legitimate employers have structured processes for collecting sensitive information and never request:

- Social Security numbers, bank account details, or credit card information before hiring

- Copies of driver’s licenses, passports, or other identity documents during initial contact

- Payment for any reason before employment begins

- Access to personal social media accounts or passwords

Unusual Payment and Employment Arrangements

Standard employment practices don’t include:

- Requests for upfront payments for any reason

- Checks sent before work is completed, especially for amounts exceeding agreed compensation

- Instructions to deposit checks and return portions of the funds

- Payment through unconventional methods like wire transfers, cryptocurrency, or gift cards

- Immediate employment offers without interviews or background checks

Lack of Verifiable Company Information

Legitimate companies have established online presences and verifiable contact information. Be cautious when:

- Company websites are poorly designed, recently created, or contain minimal information

- Physical addresses are missing, vague, or don’t correspond to actual business locations

- Phone numbers go to voicemail only or aren’t answered during business hours

- The company has no presence on professional networks or business directories

- Online reviews are entirely positive or entirely negative with suspicious patterns

Trusted Job Portals and Verification Strategies

Reputable Job Search Platforms

Major Established Platforms LinkedIn Jobs, Indeed, Glassdoor, and Monster have established reputation systems, verification processes, and fraud detection mechanisms that provide additional layers of protection for job seekers.

Industry-Specific Platforms Platforms like AngelList for startups, Dice for technology roles, or Idealist for nonprofit positions often have more stringent vetting processes for specialized industries.

Company Career Pages Applying directly through official company websites provides the highest level of legitimacy assurance, as these positions are posted directly by the hiring organizations.

Verification Techniques for Job Offers

Company Research and Validation Thoroughly research potential employers using multiple sources:

- Verify company registration through state business directories

- Check Better Business Bureau ratings and complaint history

- Review company social media presence and employee testimonials

- Search for recent news articles or press releases about the organization

- Verify physical addresses through Google Street View or local business directories

Contact Information Verification Confirm legitimacy through independent contact verification:

- Call main company phone numbers found through independent searches

- Verify email domains match official company websites

- Cross-reference contact information across multiple legitimate sources

- Test responsiveness and professionalism of communication channels

Professional Network Validation Use your professional network to verify opportunities:

- Search for current or former employees on LinkedIn

- Ask connections for insights about specific companies or opportunities

- Participate in industry forums or groups to gather information

- Consult with career counselors or professional mentors

Due Diligence Best Practices

Interview Process Evaluation Legitimate employers follow structured hiring processes that include:

- Multiple interview rounds with different team members

- Detailed discussions about job responsibilities and expectations

- Questions about your background, skills, and career goals

- Opportunities for you to ask questions about the role and company

- Clear timelines for decision-making and next steps

Reference and Background Check Procedures Professional organizations handle sensitive information appropriately:

- Requests for references come after initial interview phases

- Background checks are conducted by established third-party services

- Personal information requests are limited to job-relevant details

- Clear explanations of how information will be used and protected

Protective Strategies During Your Job Search

Personal Information Management

Gradual Information Disclosure Share personal information incrementally based on the progression of the hiring process:

- Initial applications should require only basic contact information

- Social Security numbers and detailed financial information should only be provided after job offers

- Bank account information is never required during the application or interview process

Resume Security Measures Protect your personal information in resumes and applications:

- Use a professional email address created specifically for job searching

- Include only city and state in your address, not full street addresses

- Consider using a Google Voice number for job search communications

- Avoid including birth dates, Social Security numbers, or financial information

Safe Communication Practices

Email and Phone Security Maintain security in all job search communications:

- Verify sender authenticity before clicking links or downloading attachments

- Use separate email accounts for job searching to isolate potential security risks

- Be cautious of unsolicited job offers received through social media or text messages

- Save and organize all communications for future reference and verification

Video Interview Safety Protect yourself during virtual interviews:

- Use established video conferencing platforms rather than unknown applications

- Verify interview scheduling through multiple communication channels

- Be cautious of requests to install specific software or provide system access

- Ensure your background and environment maintain professional privacy

Financial Protection

Banking and Payment Safety Never compromise your financial security during job searches:

- Legitimate employers never require upfront payments from employees

- Be suspicious of any job that involves handling other people’s money

- Never provide bank account information, credit card details, or financial passwords

- Avoid jobs requiring you to receive and forward payments or packages

Check and Payment Verification Understand how legitimate employment payments work:

- First paychecks typically come after work is completed and processed through payroll

- Payment methods should be standard (direct deposit, company checks)

- Any checks received before work completion should be verified with banks before depositing

Steps to Take if Targeted by a Job Scam

Immediate Response Actions

Stop All Communication As soon as you identify a potential scam:

- Cease all communication with the fraudulent party

- Do not provide any additional personal information

- Avoid clicking links or downloading attachments from suspected scammers

- Document all previous communications for potential reporting

Protect Your Accounts Take immediate steps to secure your personal information:

- Change passwords for accounts that may have been compromised

- Monitor bank and credit card statements for unauthorized activity

- Consider placing fraud alerts on your credit reports

- Review and secure social media privacy settings

Reporting and Documentation

File Official Reports Report job scams to appropriate authorities:

- Federal Trade Commission (FTC) through their online complaint system

- Internet Crime Complaint Center (IC3) for internet-based scams

- Your state’s attorney general’s office for local jurisdiction issues

- Local law enforcement if financial losses or identity theft occurred

Platform Reporting Report fraudulent job postings to the platforms where you encountered them:

- Job search websites have reporting mechanisms for suspicious postings

- Social media platforms can remove fraudulent accounts and postings

- Professional networks like LinkedIn take scam reports seriously

- Review websites can be alerted to fake company reviews

Recovery and Prevention

Financial Recovery Steps If you’ve experienced financial losses:

- Contact your bank or credit card company immediately

- File police reports for identity theft or financial fraud

- Consider working with identity theft recovery services

- Keep detailed records of all losses and recovery efforts

Emotional Recovery and Learning Job scam victimization can be emotionally challenging:

- Remember that falling for sophisticated scams doesn’t reflect your intelligence

- Learn from the experience to improve future scam detection

- Consider seeking support from friends, family, or professional counselors

- Use the experience to help others avoid similar scams

Preventing Future Victimization

Enhanced Vigilance Develop improved scam detection skills:

- Research every opportunity thoroughly before providing personal information

- Trust your instincts if something feels wrong about a job opportunity

- Maintain healthy skepticism about opportunities that seem too good to be true

- Stay informed about current scam trends and techniques

Building Support Networks Create systems to help verify opportunities:

- Develop relationships with career counselors or mentors who can provide guidance

- Join professional associations that offer job search support and resources

- Participate in legitimate networking groups that can provide job leads and verification

- Maintain connections with trusted colleagues who can offer insights about opportunities

Conclusion: Staying Safe While Pursuing Your Career Goals

Job search scams represent a serious threat in today’s digital employment landscape, but knowledge and vigilance can provide effective protection. By understanding common scam types, recognizing warning signs, and implementing protective strategies, you can navigate the job market safely while pursuing legitimate opportunities.

Remember that legitimate employers want to hire qualified candidates and will never ask you to pay for the privilege of working for them. Trust your instincts, take time to verify opportunities, and don’t let the fear of scams prevent you from pursuing your career goals.

The key to successful scam avoidance is maintaining a balance between healthy skepticism and openness to genuine opportunities. By following the guidelines in this comprehensive guide, you can protect yourself from fraudulent schemes while remaining receptive to the legitimate career opportunities that will advance your professional journey.

Stay informed, stay vigilant, and remember that your dream job is out there – it just requires patience, persistence, and protection to find it safely.